:max_bytes(150000):strip_icc()/dotdash_Final_Tales_From_the_Trenches_The_Rising_Wedge_Breakdown_Dec_2020-06-8f1b78c3bb8841af9e6c0a614ce06329.jpg)

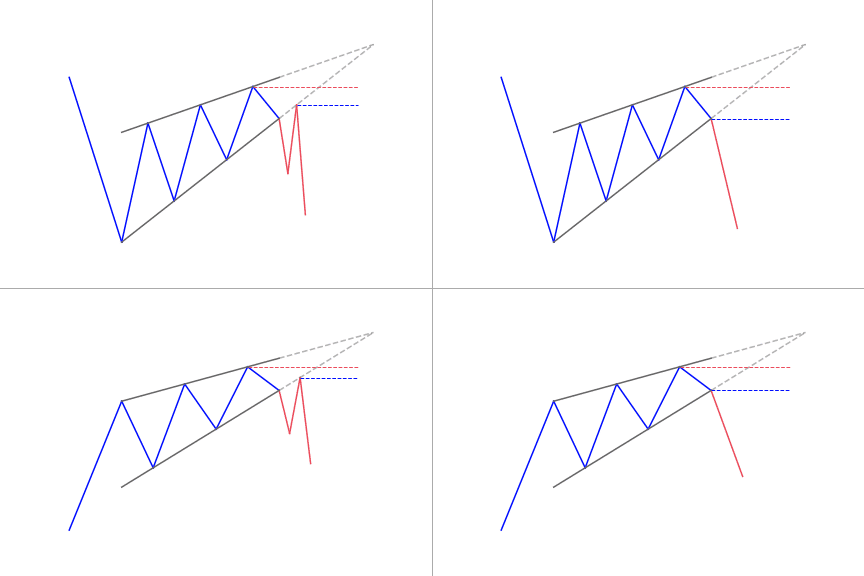

Therefore, I prefer to wait and only trade wedges in the direction I expect the breakout to occur. Don’t trust a throw-over though quite often these types of price moves quickly fail and then the price falls through the bottom of the wedge. For example, in figure 1 you may the price rise above the resistance line which some will interpret as an acceleration of the trend to the upside.

Wedges often see a “throw-over” in the direction of the trend/wedge. Therefore reversal wedges are part of the overall trend, and indicate that trend is ending when the pattern breaks out in the opposite direction of the wedge/trend. In the case of figure 2 the right side of the charts shows the price in a downtrend, but if the price breaks above resistance (horizontal line connecting the price highs of the pattern) it strongly indicates the downtrend is over and the price is likely to head higher. In the case of figure 1, AIG is in overall uptrend, but if the price breaks below the support line of the pattern (horizontal line connecting the price lows of the pattern) it is a strong indication that the uptrend is over and the price is likely to fall. Figure 1 and 2 are considered reversal patterns because the wedge is part of the overall trend and therefore when the pattern breaks it will signal a likely end to the current trend. Price will typically breakout of a wedge in the opposite direction the wedge is sloping. A falling wedge shows sellers are no longer as interested as they once were.įigure 1 shows a rising wedge in American International Group (AIG) and figure 2 a falling wedge in American Realty Capital Properties (ARCP). In a rising wedge, this pattern indicates buyers are as interested as they once were. The pattern starts with a large move, but as the pattern progress the swing highs and lows in price converge, creating a cone like shape. Wedges can be very large, creating major moves in markets and are therefore very relevant to traders on all time frames.Ī wedge occurs when the price is moving either higher or lower overall, but the price range covered is narrowing. Here we’ll learn how to identify a wedge as either a reversal or continuation pattern, or then how to trade it. Depending on trend direction and the angle of the wedge, that could mean there are occasions when a wedge is a continuation pattern.

Rising wedges are bearish and falling wedges are bullish. The wedge is fairly common pattern, and if you familiar with Elliott Wave analysis a wedge often appears in wave 5–the final stage–of a trend.

0 kommentar(er)

0 kommentar(er)